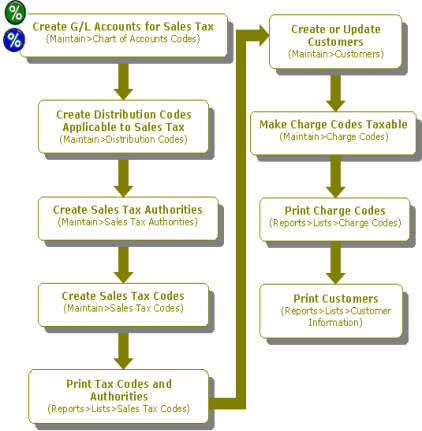

How Do I Set Up Sales Tax?

The following is a checklist for setting up sales taxes in the Accounts Receivable Billing module:

- Create appropriate G/L accounts for Sales Tax Payable - Other Liabilities (OL) type accounts (Maintain>Chart of Accounts Codes).

- Create a sales tax distribution code (Maintain>Distribution Codes).

- Create sales tax authorities for all entities served by your organization (Maintain>Accounts Receivable>Sales Tax Authorities).

- Create sales tax codes (Maintain>Accounts Receivable>Sales Tax Codes).

- Print a list of sales tax codes and their authorities (Reports>Accounts Receivable>Sales Tax Codes).

- Create or update customers, including their addresses, contact information, billing terms, and default accounts (Maintain>Accounts Receivable>Customers). Taxable customers must have a Shipping Address with a sales tax code selected. The system automatically generates a <Billing> Shipping Address based on the Billing Address data, for all Customers without a Shipping Address. If the customer is taxable (which is selected on the Maintain>Accounts Receivable>Customers>Billing and Terms tab), you must select a Sales Tax Code for the <Billing> Shipping Address (Maintain>Accounts Receivable>Customers>Addresses>Shipping Address).

- Create or modify charge codes to make them taxable (Maintain>Accounts Receivable>Charge Codes tab).

- Print a list of charge codes (Reports>Accounts Receivable>Charge Codes).

- Print a list of customers (Reports>Accounts Receivable>Customer Information).