Allocation Methods

Allocation methods are assigned when you add a new allocation code to the system (Maintenance > Allocations > Allocation Codes > Add Allocation Code). This topic describes each allocation calculation method and provides examples for their use.

Note: The "Employee Headcount" and "Labor Hours" allocation methods are only available if the Payroll module has been installed.

MIP supplies 8 allocation calculation methods. Select a method below to learn more.

| Allocation Base | Indirect Cost Rate Cap Available? | Cost Type Example |

| Space utilization, full-time equivalents (FTEs) | Yes |

Facilities rent, janitorial costs, utilities |

This method can be combined with the Indirect Cost Rate (ICR) capping feature to limit the calculated allocation to a prescribed Indirect Cost Rate.

When can I use this method?

Use the Table method when you have fixed percentages of the Pool account to allocate from and you know the percentage of the pool you want allocated to the Recipient accounts. This method is not based on activity.

Example:

Your organization needs to allocate the utility bill costs in an equitable manner across three programs that utilize space in the building.

Using square footage as a cost driver, you calculate that Program 1 uses 25% of the building space, Program 2 uses 25%, and Program 3 uses 50%.

You can use the table method to specify these percentages to allocate the utility bill equitably.

| Allocation Base | Indirect Cost Rate Cap Available? | Cost Type Example |

| Direct salaries | Yes | General administrative |

This method can be combined with the Indirect Cost Rate (ICR) capping feature to limit the calculated allocation to a prescribed Indirect Cost Rate.

Note: If you use this allocation method and select the "Use indirect cost limit cap" check box on the "Allocation Details" tab (see Add Allocation Codes), you must choose a beginning date for the selected indirect cost rate segments.

When can I use this method?

Use the Indirect Cost Rate method when there is a limit to the rate at which funds can be allocated.

The indirect cost rate cap is applied according to the following rules:

Rule 1:

If the indirect cost limit is calculated to be zero or positive (Debit cap), then the Proposed Allocation is only adjusted if it would cause the recipient accounts to exceed the indirect cost limit in a positive (debit) direction. For example:

| Proposed Allocation | Posted Amounts | Indirect cost limit |

| 500.00 | 1000.00 | 1300.00 |

Using this example, 200.00 remains in the pool.

Rule 2:

If the indirect cost limit is calculated to be less than zero (Credit cap), then the Proposed Allocation is only adjusted if it would cause the recipient accounts to exceed the indirect cost limit in a negative (credit) direction. For example:

| Proposed Allocation | Posted Amounts | Indirect cost limit |

| (500.00) | (1000.00) | (1300.00) |

Using this example, (200.00) remains in the pool.

Rule 3:

If the Proposed Allocation plus the Posted Amounts do not exceed the indirect cost limit (in accordance with Rules 1 and 2), then no adjustment is needed and the Proposed Allocation amount is applied in full. For example:

| Proposed Allocation | Posted Amounts | Indirect cost limit |

| 500.00 | 1000.00 | 1600.00 |

Using this example, the entire Proposed Allocation amount is applied.

Rule 4:

If the Posted Amounts reach or exceed the indirect cost limit before consideration of the Proposed Allocation, then the allocation amounts for the affected recipient lines are set to zero, and an information code of "XCAP" is applied to those lines.

The system continues to allocate for all lines where the indirect cost limit is not reached, or exceeded by the Posted Amounts. For example:

| Proposed Allocation | Posted Amounts | Indirect cost limit |

| 500.00 | 1000.00 | 900.00 |

Using this example, no allocations are made. The entire 500.00 amount remains in the pool.

Example:

A grantor has stipulated they will reimburse no more than 15% of your organization's administrative costs (or your organization may have otherwise determined an appropriate rate to allocate indirect cost).

Use this method to ensure that costs are allocated based on that known Indirect Cost Rate.

The system will allocate based on the Indirect Cost Rates defined in the Allocation Code (see Add Allocation Codes).

Note: Any leftover funds will not be allocated and will remain in the Pool account using this method.

| Allocation Base | Indirect Cost Rate Cap Available? | Cost Type Example |

| Related direct expenditures | Yes | Supplies, fringe costs, administrative staff |

This method can be combined with the Indirect Cost Rate (ICR) capping feature to limit the calculated allocation to a prescribed Indirect Cost Rate.

When can I use this method?

Use this method to allocate based on the relative balance an account carried at a given point in time.

Example:

Your organization employs school administrators who are salaried (a fixed cost that benefits multiple educational programs).

The Relative Account Balances calculation method can take the administrative salaries and allocate them based on the relative direct cost balances of the Recipient programs accounts to ensure a proportional distribution across the recipient programs.

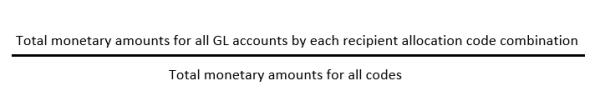

The calculation goes as follows:

| Allocation Base | Indirect Cost Rate Cap Available? | Cost Type Example |

| Balance of investment account | Yes | Pooled investment revenues and costs |

This method can be combined with the Indirect Cost Rate (ICR) capping feature to limit the calculated allocation to a prescribed Indirect Cost Rate.

When can I use this method?

Use this method to allocate costs based on the average balances in an account weighted daily over a period of time.

Example:

Your organization uses a company credit card to purchase supplies used in various programs.

Each month there are fees and interest expenses which accrue to the use of the credit card.

You can use this method to allocate the fees and interest expenses based on the weighted average daily balance of the expenses charged by each of the recipient programs.

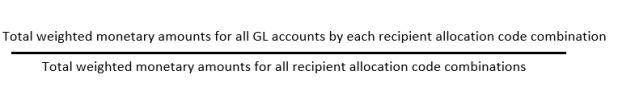

The calculation goes as follows:

| Allocation Base | Indirect Cost Rate Cap Available? | Cost Type Example |

| Number of employees | Yes | Telephone costs, data processing costs |

This method can be combined with the Indirect Cost Rate (ICR) capping feature to limit the calculated allocation to a prescribed Indirect Cost Rate.

When can I use this method?

Use this method to calculate allocation percentages based on the number of employees in your organization.

Example:

Your organization provides after school care for children and has 10 Activities Counselors on its staff, all at the same pay rate.

You can use this method to calculate allocation percentages based on the proportional head count of employees servicing each program.

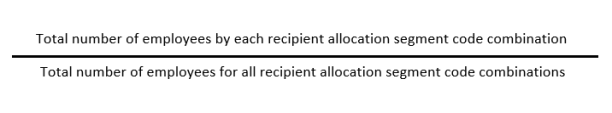

The calculation goes as follows:

| Allocation Base | Indirect Cost Rate Cap Available? | Cost Type Example |

| Labor hours | Yes | Indirect payroll costs |

This method can be combined with the Indirect Cost Rate (ICR) capping feature to limit the calculated allocation to a prescribed Indirect Cost Rate.

When can I use this method?

Use this method to allocate costs based on the proportional number of hours worked during a given period of time.

Example:

Your organization provides in-home nursing care at a fixed rate for various programs.

In Q1, there were a total of 250 labor hours billed.

You can use this method to calculate allocation percentages based on the proportional share of labor hours charged to each program.

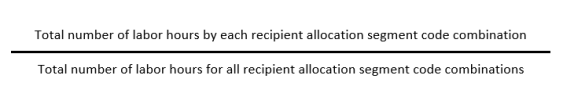

The system will compare the hours accrued to each Recipient account combination to the total labor hours to derive the allocation percentage.

The calculation goes as follows:

| Allocation Base | Indirect Cost Rate Cap Available? | Cost Type Example |

| Number of transaction lines | Yes | Administrative costs, data processing costs |

This method can be combined with the Indirect Cost Rate (ICR) capping feature to limit the calculated allocation to a prescribed Indirect Cost Rate.

When can I use this method?

Use this method to allocate costs based on the number of transactions processed for the recipient account codes within a given period.

Example:

Your organization's accounting staff provide services for all programs.

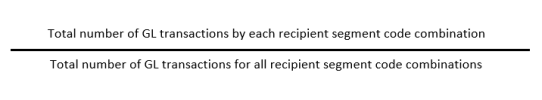

You can use this method to allocate the accounting costs based on the proportional share of the transactions attributable to each program.

The calculation goes as follows:

| Allocation Base | Indirect Cost Rate Cap Available? | Cost Type Example |

| Number of customers served | Yes | Facilities |

This method can be combined with the Indirect Cost Rate (ICR) capping feature to limit the calculated allocation to a prescribed Indirect Cost Rate.

When can I use this method?

This allocation calculation method serves as a catch-all method if none of the other methods suit your organization's need.

Example:

Your organization provides free classes to individuals and families.

Classes include Financial Planning, Family Counseling, Life Skills, etc.

Your grantor gives your organization $150 for each person that enrolls in a session to help cover costs.

You can set up a UDF capable of counting each session, then allocate the benefit based on the proportional share of classes performed in each program. See User Defined Fields for more information on setting up UDFs to be used throughout the system.

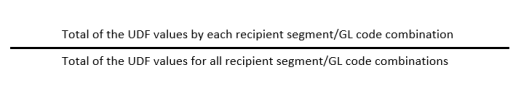

The calculation goes as follows: