Manual Bank Reconciliation

Match your organization’s cash activity in MIP with the activity shown on your bank statement. Every transaction posted to a cash account is tracked in a subsidiary ledger, making it easy to compare, reconcile, and report on differences. If you need to record bank errors, general ledger corrections, or other adjustments, you can enter them on the Suspense Items tab.

If you're an Auto Payment user, see Auto Payment Bank Reconciliation for steps on how to perform your reconciliation.

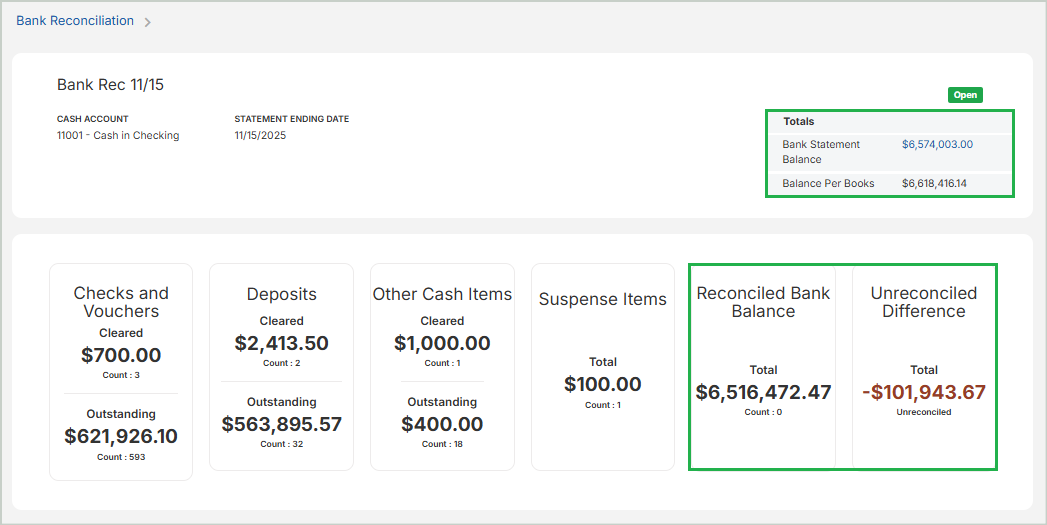

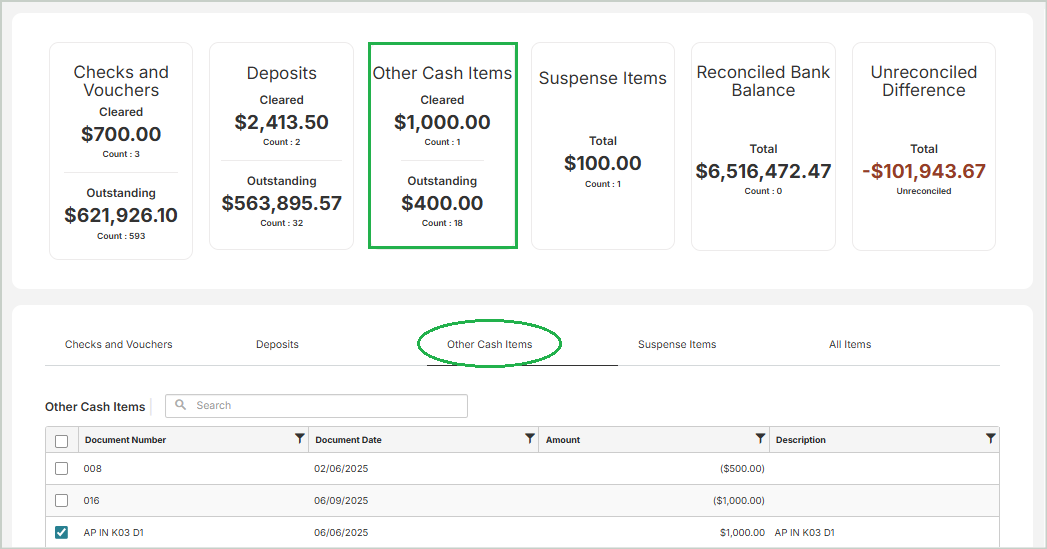

Bank Reconciliation Summary

The top section displays a summary of the totals included in the reconciliation.

-

Bank Statement Balance: The ending balance you entered from your bank statement when you added a new reconciliation. MIP uses this amount to calculate the Unreconciled Difference. You can update this value by selecting the balance and entering a new amount. Note that balances in locked reconciliations cannot be edited.

-

Balance Per Books: A system-generated value - MIP calculates the cash account's general ledger balance automatically as of the Statement Ending Date.

-

Reconciled Bank Balance: The bank balance after accounting for all cleared items during the reconciliation process. This total updates automatically as you clear items. When all items are properly cleared, this should match the Bank Statement Balance.

-

Unreconciled Difference: The difference between the Reconciled Bank Balance and the Balance Per Books. This total automatically updates as you clear items. Your cash account is fully reconciled when the Unreconciled Difference is $0.00. A large difference indicates that items may be missing, incorrectly recorded, or not yet cleared.

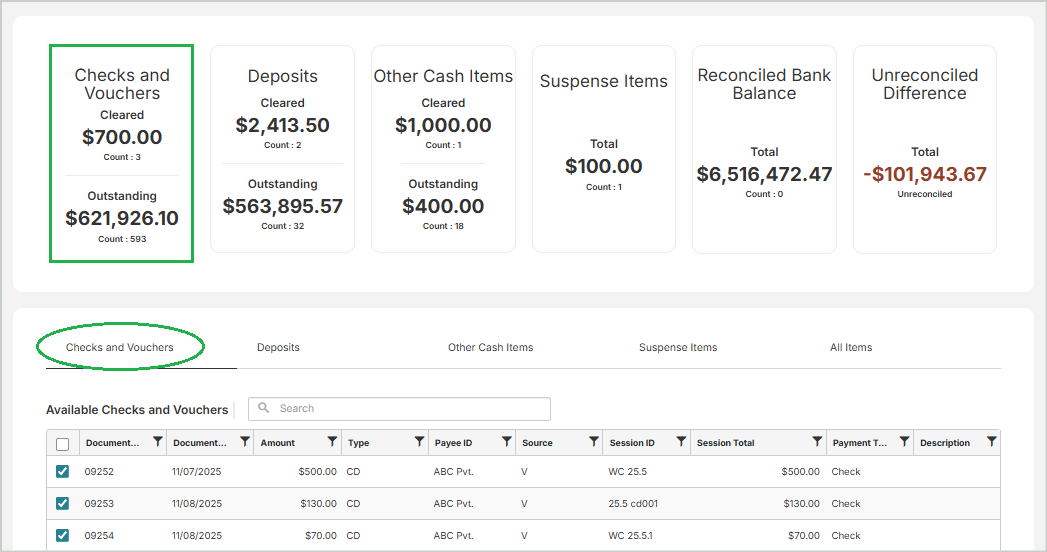

Reconcile Items

MIP presents a card for each transaction type, summarizing the total Cleared and Outstanding items. Each card is linked to a corresponding tab below. As you clear items in each tab, the associated card updates in real time to reflect the new Cleared and Outstanding totals.

- Checks and Vouchers

- Deposits

- Other Cash Items

- Suspense Items

- All Items

Use the Checks and Vouchers tab to identify which checks and vouchers have cleared the bank. This tab includes posted items that were entered as Cash Disbursements, Write Checks, Void Checks/Vouchers/Invoices, AP Checks/Vouchers, and Payroll Checks/Vouchers.

The Checks and Vouchers grid includes the following columns:

Document Number: The document number

Document Date: The date of the document

Amount: The document's amount

Type: The type of document, such as a Cash Disbursement (CD) or Voided Check (V). CD represents all posted checks / vouchers and could have been created using the Enter Cash Disbursements, Enter Manual AP Checks, Write Checks, or Pay Selected AP Invoices forms. CD could also represent a check created in the Payroll module. Keep in mind that once a cash disbursement is voided, its type changes from CD to V.

Payee ID: The unique ID that is assigned to this Payee

Source: The source of the disbursement, such as Employee (E) or Vendor (V). Employee originates from Payroll and Vendor from Accounts Payable. Note that no source is identified for General Ledger type checks.

Payment Type: The payment type - either Check or Voucher

Description: The description of the check or voucher

Session ID: The session identifier. This column can be used to identify multiple documents that were submitted in the same session.

Session Total: The total amount of all documents included in the session

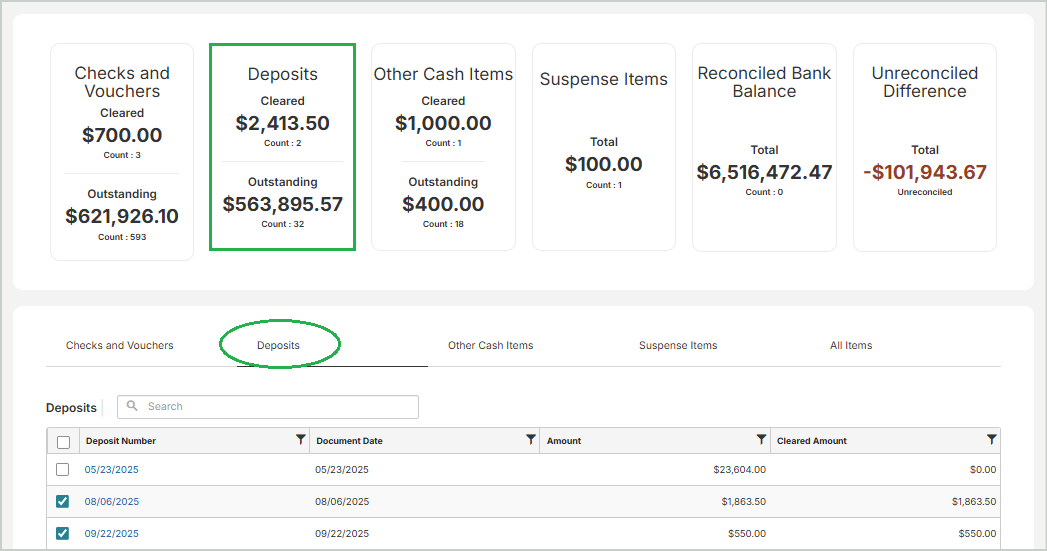

Use the Deposits tab to identify deposits that have cleared the bank. Select the blue link in the Deposit Number column to open the Deposit Detail form.

Earlier, when transactions were entered through Cash Receipts, Write Receipts, or AR Receipts, you were given the opportunity to specify a deposit number for each document.

-

If a deposit number was assigned, and there is more than one document with the same deposit number and date, these items are totaled and shown as one deposit on this tab.

-

Furthermore, even if a deposit number was not entered, documents with the same date are totaled and shown as one deposit.

The Deposits grid includes the following columns:

Deposit Number: The number for each deposit. Select a Deposit Number to view specific details for the deposit. Note that deposit numbers are optional during transaction entry. Deposits are entered as cash receipts (CR) or accounts receivable receipts (ARC).

Document Date: The document date

Amount: The amount of the deposit

Cleared Amount: The amount of which the document actually cleared the bank or displays the original document amount if it has not cleared. If appropriate, change the functional cleared amount.

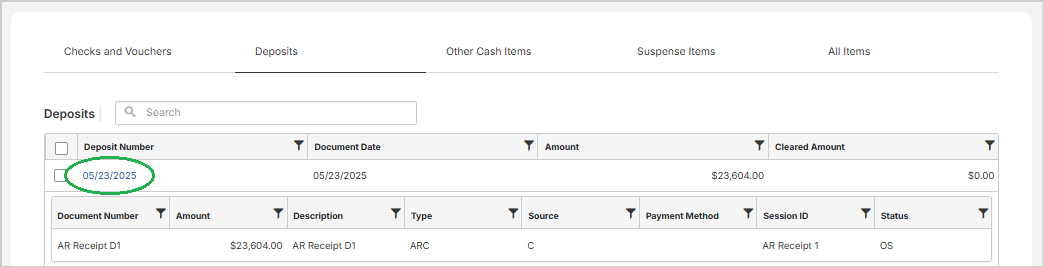

Deposit Detail

Select a Deposit Number to view specific details for the deposit.

Document Number: The check number for each item

Amount: The amount of the deposit

Description: The description of the deposit

Type: The deposit type (CD - Cash Disbursement, CR - Cash Receipts, or ARC - Accounts Receivable Receipts)

Source: The source of the deposit, such as Customer (C). Note that no source is identified for General Ledger type deposits.

Payment Method: The payment method

Session ID: The session identifier

Status: The status (CL - Cleared, OS - Outstanding)

Use the Other Cash items tab to clear other cash items (transactions which debit or credit a cash account). This tab includes posted items that were entered as Journal Vouchers, AP Invoices, AP Credits, AR Invoices, and AR Credits.

For example, assume bank service charges were entered as a Journal Voucher entry. This adjustment affects the cash account and must be cleared on this tab.

The Other Cash Items grid includes the following columns:

Document Number: The document number

Document Date: The date of the document

Amount: The amount of the document

Description: The description of the document

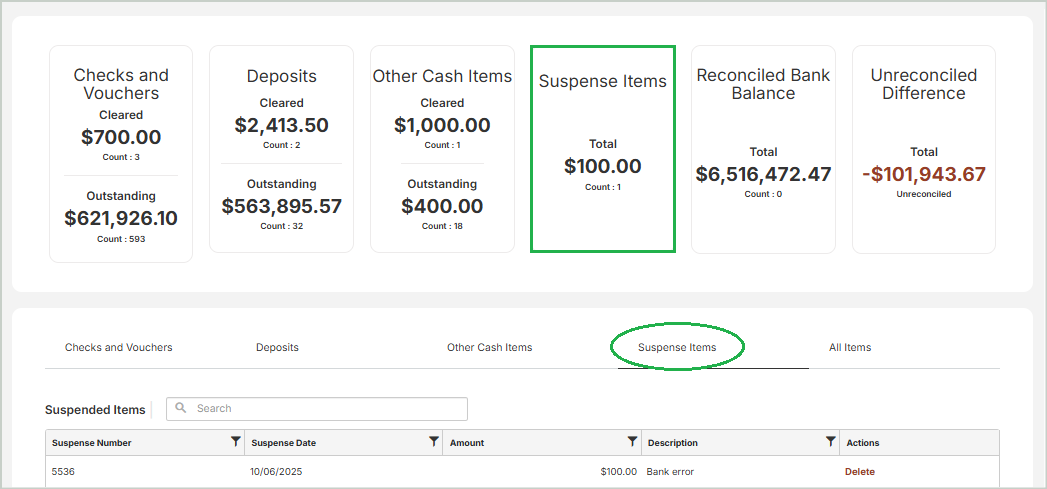

Use the Suspense Items tab to manually add or delete suspense items. These are reconciling items that typically aren’t recorded as transactions - for example, a bank error. Since these items affect reconciliation but not your general ledger, they should only be entered here, not as actual transactions.

Once the issue is resolved in a future reconciliation period and the item is no longer causing a difference, you can manually delete it from this tab.

Note: A suspense item cannot be entered or deleted under a locked reconciliation. You must first unlock the associated Reconciliation ID.

The Suspense Items grid includes the following columns:

Suspense Number: Enter a unique number for the suspense item for tracking purposes.

Suspense Date: Enter a unique date for the suspense item for tracking purposes.

Amount: Enter the amount of the suspense item (positive or negative).

Description: Enter a description of the suspense item.

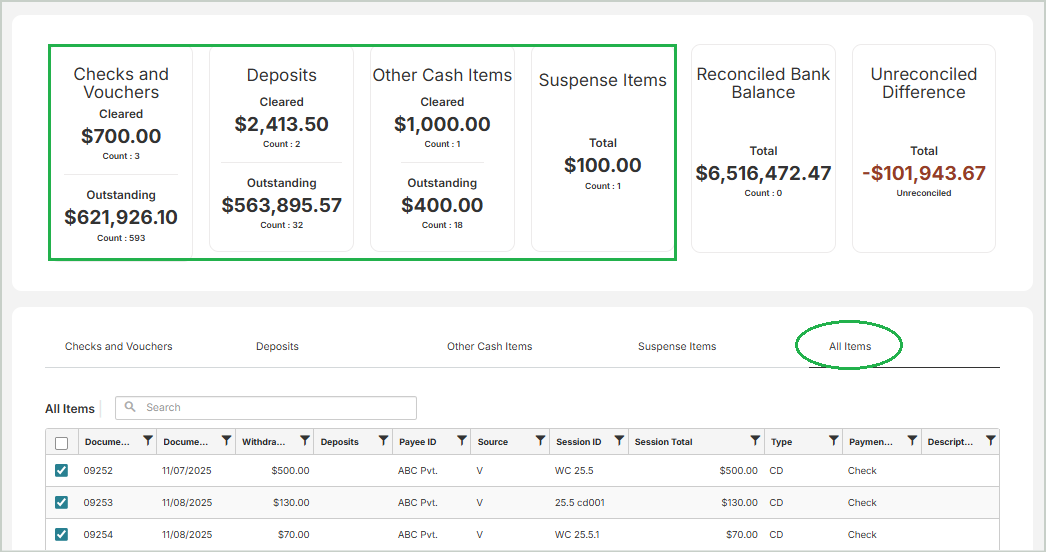

The All Items tab consolidates all transactions from each individual tab (Checks and Vouchers, Deposits, and Other Cash Items), allowing you to view a complete list in one place.

The All Items grid includes the following columns:

Withdrawals: The amount of withdrawals associated to the document

Deposits: The amount of deposits associated to the document.

Payee ID: The unique ID that is assigned to this Payee

Source: The source of the disbursement, such as Employee (E) or Vendor (V). Employee originates from Payroll and Vendor from Accounts Payable. Note that no source is identified for General Ledger type checks.

Type: The type of document, such as a Cash Disbursement (CD) or Voided Check (V). CD represents all posted checks/vouchers and could have been created using the Enter Cash Disbursements, Enter Manual AP Checks, Write Checks, or Pay Selected AP Invoices forms. CD could also represent a check created in the Payroll module. Keep in mind that once a cash disbursement is voided, its type changes from CD to V.

Payment Type: The payment type - either Check or Voucher

Description: The description of the check or voucher

Session ID: The session identifier

Session Total: The total amount of all documents in the session

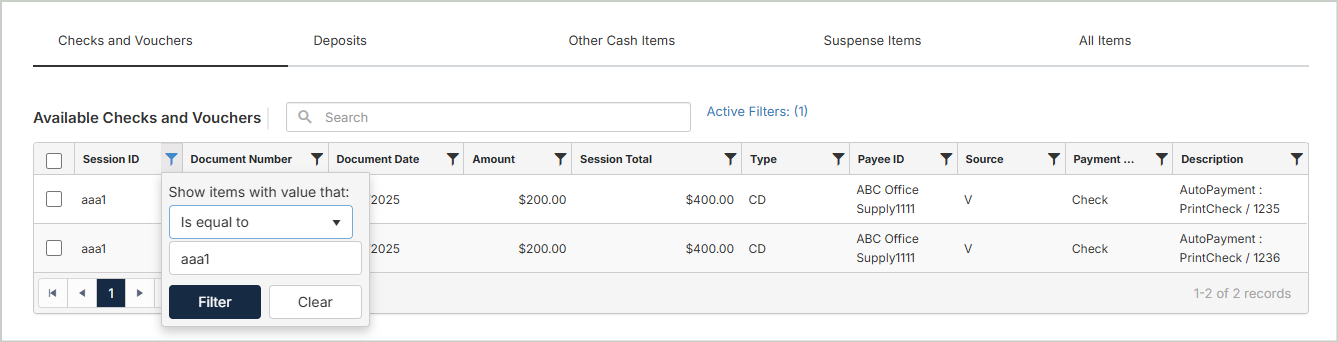

How to Filter & Clear Items

You can apply column filters to focus on only the items you want to view and clear. Filtering is available on both the Checks and Vouchers and All Items tabs.

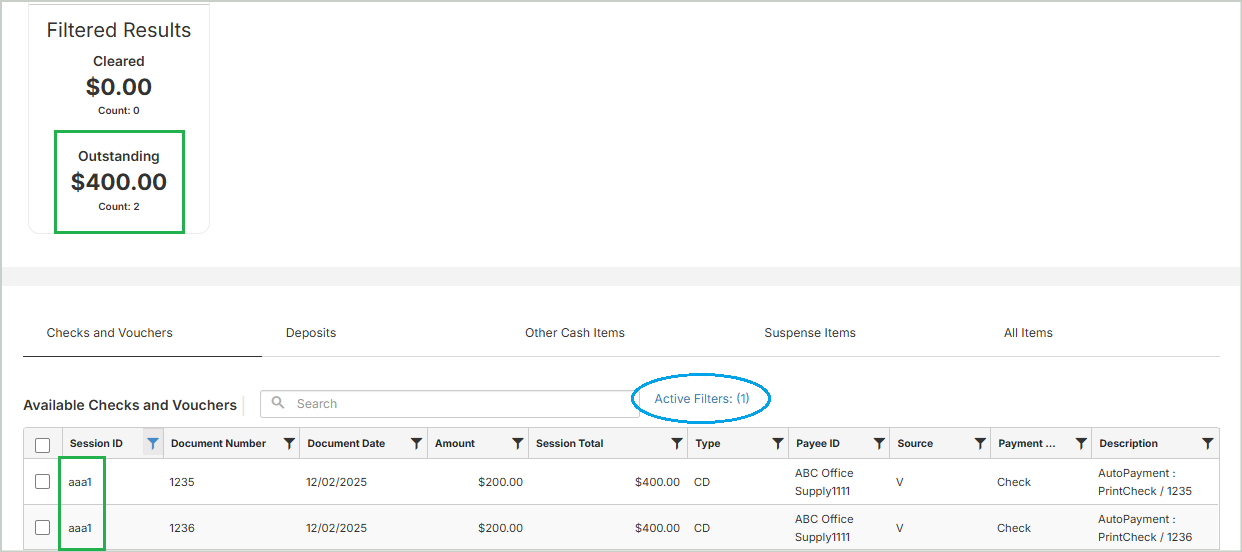

Once you apply one or more filters, a Filtered Results card appears above the grid. This card shows the Outstanding total for only the items that match your filters, making it easy to verify you’re clearing the correct items.

Step 1 - Apply Filters to Narrow Your Results

Set column filters to narrow down the items you'd like to view and clear. You can filter on any column, giving you flexibility to isolate specific sessions, amounts, dates, or other criteria.

Example:

-

Session ID → Is equal to → aaa1

Step 2 - Verify Your Filtered Results

The grid will now display only the items that match the filters you applied. After applying your filters, select the Active Filters link above the grid to confirm which filters are currently in effect.

-

The Outstanding amount in the Filtered Results card represents the total of all items under your filter criteria.

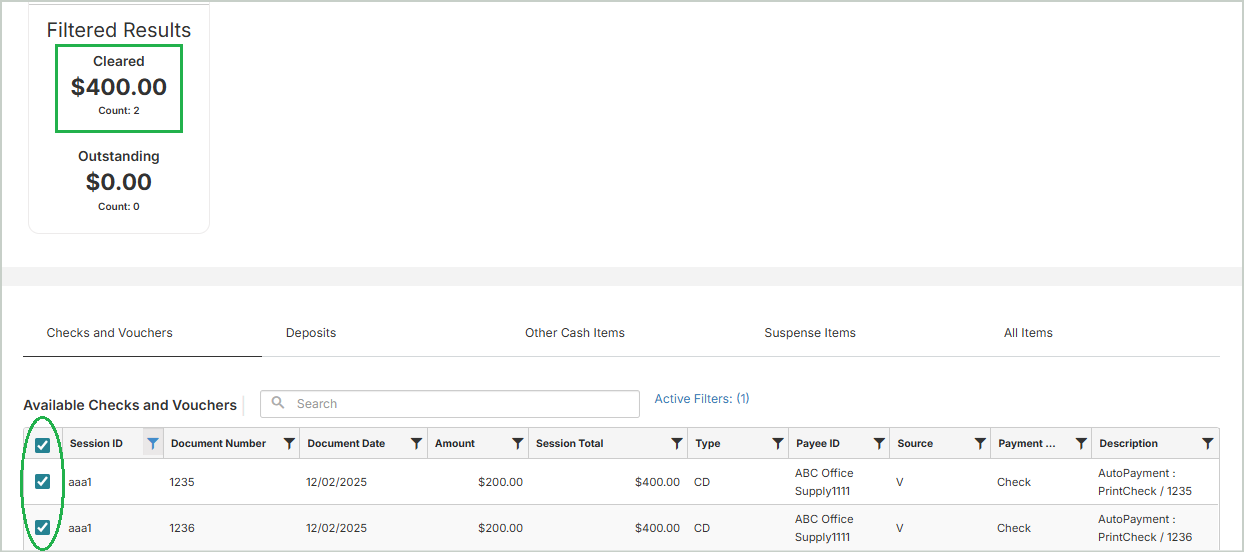

Step 3 - Clear the Items

Select the checkbox at the top left of the grid to clear all items under the current filters.

The following will update automatically:

-

Cleared amount in the Filtered Results card

-

Cleared amount in the Checks and Vouchers card

-

Reconciled Bank Balance and Unreconciled Difference totals

Once you've cleared all items, you can repeat the filtering process or clear your column filters to return to the default view.

Run Your Report

Select Run Report to export the Reconciliation Report. You can choose to run either a Detail Report or a Summary Report based on the reconciliation data. This report serves as your historical record of the reconciliation.

When you run the report, it is added to the Report Queue at the bottom of the MIP window. You can continue working in other areas of MIP while the report generates. Once complete, the report is available as a downloadable file.

Best Practices

If additional activity is entered after a reconciliation period is completed - and the reconciliation is not locked - the reconciliation results can change. This means the original reconciliation trail may be lost.

To preserve an audit trail and demonstrate that the account was reconciled at a specific point in time, we recommend the following best practices:

-

Run and save the Reconciliation Report (print or store a copy)

-

Lock the reconciliation once it is complete

-

Update entry date restrictions to prevent posting activity into the reconciled period (Organization Settings > Preferences > Entry Dates > Prohibit)

-

Locking the reconciliation protects it from changes and provides evidence that the account was reconciled accurately at that time