Actual Expense vs. Budget Expense

The Actual Expense vs. Budget Expense chart compares your organization's actual expenses to budgeted expenses for the current fiscal year. The first bar represents your actual expenses and the second bar represents your budgeted expenses. Hover over a bar in the chart to view the exact amount details for the month. Select a bar to drill down into the corresponding GL codes and documents.

Details

Selected Month: The selected month for the expense details

Budget Version: The primary budget version

Fiscal Year Beginning Date: The first day of the fiscal year for which you're entering transactions. This date cannot be changed after the organization is created.

Transaction Date From: The start date of the month for the transaction

Transaction Date Through: The actual transactions through the current date (the date you log in into the system) when you're viewing the current month. Otherwise, it specifies the end of the month date for the selected period.

Codes

To search for a specific GL code, enter the code into the search box at the upper left corner of the grid. All the transactions that match will display in the grid. To view an individual expense for a code, select an Expense from the grid.

GL Code: The ID associated with the Expense type

GL Title: The title assigned to the GL code

Expense The actual expense incurred for the line item. Select an Expense to view its details.

Budget: The budgeted or estimated expense for the line item

Difference: The amount difference is calculated by subtracting the actual expense from the budget expense.

%: The percentage difference is calculated by subtracting the actual expense from the budget expense, and dividing the difference by the budgeted amount for that GL Code.

Actual Expense vs. Budget Expense

At the bottom of the page, the system displays a snapshot of the actual vs. budget expenses for the selected month.

Budget Total: The budgeted or estimated total for the specified month of the primary budget version

Expense Total: The actual expense incurred for the specified month of the primary budget version

Variance: The amount difference is calculated by subtracting the actual Expense Total from the Budget Total.

Percent Variance: The percentage difference is calculated by subtracting the actual Expense Total from the Budget Total, and dividing the difference by the budgeted total for the month selected.

Here's an example of how MIP calculates the Percent Variance:

MIP subtracts the budgeted amount from the actual amount to find the increase or decrease from the budgeted amount. The system then divides the difference by the budgeted expense. If you budgeted $1,000 for broker fees and you spent $1,500, subtract $1,000 from $1,500 to find you went over budget by $500. Then divide $500 by $1,000 to get 0.5%.

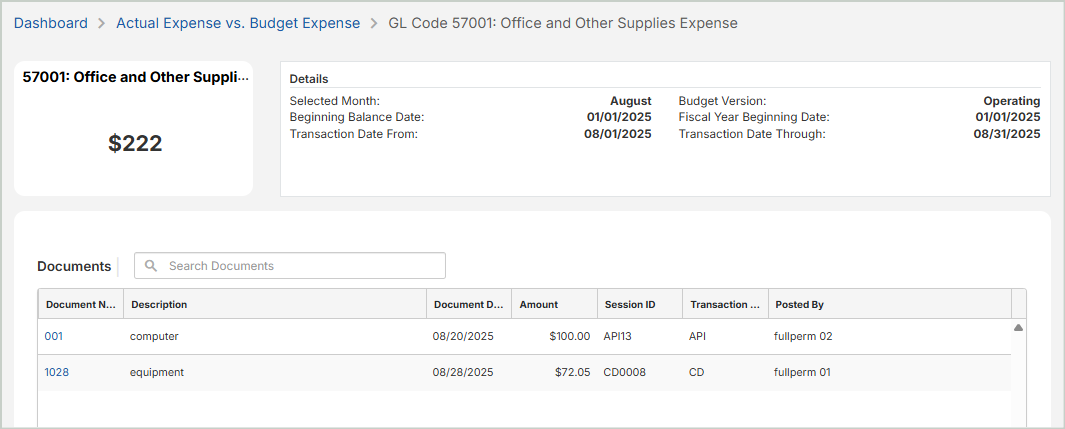

View Expense Details for a GL Code

Select an Expense from the grid above to view expense details for a specific code.

Details

Selected Month: The selected month

Budget Version: The primary budget version

Beginning Balance Date: The beginning date of an accounting period

Fiscal Year Beginning Date: The first day of the fiscal year for which you're entering transactions

Transaction Date From: The start date of the month for the transaction

Transaction Date Through: The actual transactions through the current date (the date you log in into the system) when you're viewing the current month. Otherwise, it specifies the end of the month date for the selected period.

Documents

To search for a specific document, enter the document number or description into the search box.

Document Number: The number assigned to the document. Select a Document Number to view the transactions entered for the document.

Description: The description of the document

Document Date: The date entered on the transaction document

Amount: The amount incurred for the line item

Session ID: The session ID assigned to the batch of documents

Transaction Source: The transaction type which includes expense type GL codes

Posted By: The user who posted the document

Posted Date: The date the document was posted

Actual Expense vs. Budget Expense - GL Code

At the bottom of the page, the system displays a snapshot of the actual vs. budget expenses for the selected GL Code.

Beginning Balance: The total balance at the beginning of an accounting period

Debit Total: The total amount of all debit transactions

Credit Total: The total amount of all credit transactions

Ending Balance: This balance is calculated by taking the Beginning Balance and applying the current activity (Debit Totals and Credit Totals).