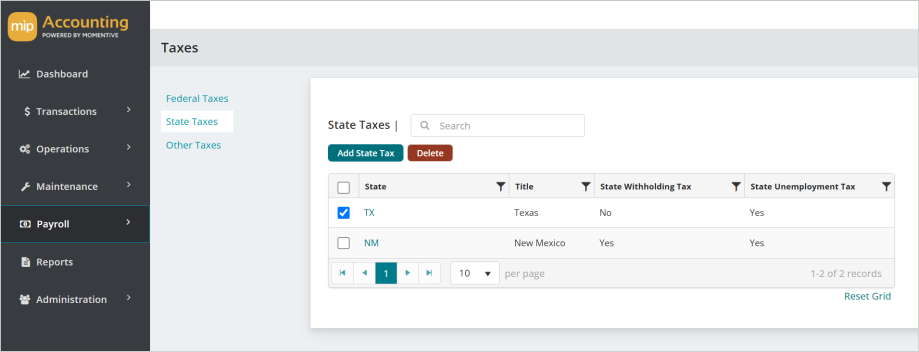

State Taxes

Specify how the system is to account for the state tax withheld from employees' checks. This not only accommodates the employee's state tax withholding, but also the employer-paid state tax expense. Also, you can specify the federal unemployment tax credit rate information.

Select a link below to learn more about the fields in each section.

On this tab, set up codes for the states in which employees are subject to tax. Also, specify which taxes are included: state withholding and/or state unemployment. You must also enter the organization's Employer Tax ID.

| Code |

Enter a two-character state or territory code. |

| Title | The description of the code. |

| State Withholding Tax and Tax Account ID | Select State Withholding Tax, if applicable, and enter the SWT tax account ID number for the selected state. |

|

State Unemployment Tax and Tax Account ID |

Select State Unemployment Tax, if applicable. Enter the SUTA tax account ID number for the selected state. |

Note: Each applicable state's withholding tables do not have to be entered. These are built into the system. Once a state has been entered, the system automatically accesses that state's tax tables.

Note: Note that once a particular state has been activated for either state withholding and/or state unemployment, this state must be included on the employee's Employee Information form to make it applicable for that employee.

Note: If your organization is not subject to SUTA and your state does not require SUTA reporting, then clear the "State Unemployment Tax" checkbox. If your organization is not subject to SUTA but your state does require SUTA reporting, select the "State Unemployment Tax" checkbox, then enter a percentage of "0" in the "Percentage of Wages" box in the "State Unemployment Tax" section. In both cases, the amount of FUTA will be calculated at 6.0%. Otherwise, FUTA will be calculated at .6%.

Use this section to specify the accounts the system should use to create entries for state withholding taxes, and to specify the Expense and Liability Accounts to which the taxes apply. Also, you can specify a state’s federal unemployment tax credit rate information.

| Liability Account | Enter the General Ledger liability account for state withholding. This box is required if the "State Withholding Tax" checkbox was selected in the "State Tax Details" section. |

Use this tab to specify State Unemployment Tax information.

| Calculation Method |

Accept the default of "(Y) Year To Date" or select a Calculation Method of "(C) Current".

|

|

Employer Maximum Annual Subject Wages |

Enter the maximum subject wages for the employer. |

|

Employer Percent of Wages |

Enter the percentage of maximum subject wages for the employer.

|

|

Employee Maximum Annual Subject Wages |

Enter the maximum subject wages for the employee. |

|

Employee Percent of Wages |

Enter the maximum subject wages for the employee. |

|

Liability Account |

Enter the General Ledger liability account to which the State Unemployment Taxes apply.

|

|

Expense Account |

If the Employer pays the tax, enter the General Ledger expense account to which the state Unemployment Taxes apply.

|

Note: If your organization is not subject to SUTA and your state does not require SUTA reporting, then clear the "State Unemployment Tax" checkbox. If your organization is not subject to SUTA but your state does require SUTA reporting, select the "State Unemployment Tax" checkbox, then enter a percentage of "0" in the "Percentage of Wages" box in the "State Unemployment Tax" section. In both cases, the amount of FUTA will be calculated at 6.0%. Otherwise, FUTA will be calculated at .6%.

Note: Even if State Unemployment Tax is employer-paid, the appropriate state must be entered in Employee Information. Otherwise, State Unemployment Taxes are not calculated.

Select the "Override Default Credit Rate" checkbox, if you need to enter changes to the FUTA Credit Rate for the FUTA Tax. The system defaults to 5.4%, which is the maximum allowed by the federal government. Check the federal regulations, as some states are required to reduce the amount of credit taken below 5.4%.

Accept the default FUTA Credit Rate of 5.4% or enter a rate that is lower than the maximum allowed for the Federal Unemployment tax credit.

Note: For example, if your state is required to reduce the Federal Unemployment tax credit by .3%, you would enter 5.1% in this field. This value must be greater than or equal to zero and less than the active Percent of Wages defined on the Payroll > System Setup > Taxes > Federal Taxes > FUTA Taxes form.

Use this section to specify how to distribute State Unemployment Taxes only if paid by the Employer.

Choose to have state unemployment amounts distributed the same way the employee's earnings are distributed; limit distribution to the earnings used to calculate the state tax; or distribute State Unemployment Taxes using a specific Distribution Code selected in this section.

Follow Earnings on Timesheet: The tax is distributed to the same Account Codes (except General Ledger) as the employee's earnings on their timesheet. If more than one distribution code is used to distribute the employee's earnings on the timesheet, the taxes are distributed based upon a weighted average of the distributed earnings.

Follow Earnings Used to Calculate the Tax: Limits the distribution used to calculate the tax to the earning codes specified. The tax is distributed to the same Account Codes (except General Ledger) as the employee's earnings. If more than one distribution code is used to distribute the employee's earnings, the taxes are distributed based upon a weighted average of the distributed earnings.

Use Distribution Code: Use this distribution method if there are one or more funding sources to which you do not distribute state taxes.

Note: If there are one or more funding sources to which you do not distribute state unemployment taxes (because you may have a negotiated rate or state unemployment taxes are simply disallowed), you can choose the Use Distribution Code distribution method. For this method, specify the exact Distribution Code to distribute the state taxes, which may be entirely or partially distributed to overhead. If a Distribution Code is specified in this section, it should be an existing Distribution Code.

Note: Many grants and contracts allow state unemployment taxes to be charged directly to the funding source. In this case, choose Follow Earnings on Timesheet or Follow Earnings Used to Calculate the Tax. The employer's portion of the state unemployment taxes are distributed to the same Account Codes (Fund and any other account segments except General Ledger) as the employee's earnings. In other words, the Distribution Codes used to distribute the employee's earnings are also used to distribute the state unemployment tax. If more than one Distribution Code is used to distribute the employee's earnings, the state unemployment taxes are distributed based upon a weighted average of the distributed earnings. Note that State Withholding is not an expense of the employer and therefore does not require allocation.

Once you're finished with your edits, Save your changes.

Note: There are several states with special rules for their state taxes. If the employee resides in Illinois, Mississippi, Marianas Protectorate, Massachusetts, Republic of Marshall Islands, or Republic of Palau, see Miscellaneous State Taxes.