Information

The Information section in Organization Settings contains multiple tabs, each for applying specific settings.

Select a tab below to learn more about each setting.

- Details

- Address

- Segments

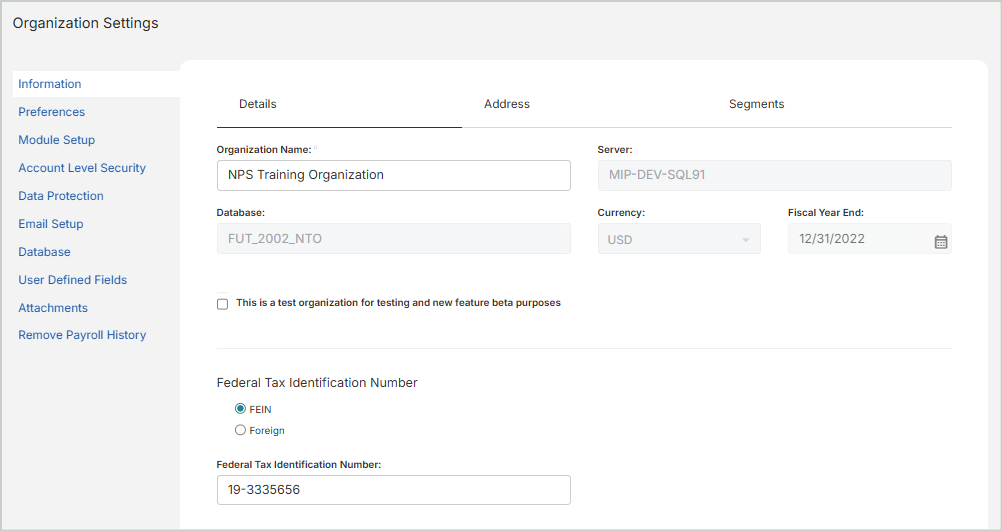

Use the Details tab to update your organization name, configure it for testing purposes, and update withholding information.

Organization Details

Organization Name: Enter or update your organization's name.

Server: Displays the server your organization is using (read-only).

Database: Displays your organization’s database (read-only).

Currency: Displays your organization’s default currency (read-only).

Fiscal Year End: Displays your organization’s fiscal year end (read-only).

Test Organization

This is a test organization for testing and new feature beta purposes: Select this option if you'd like the organization you're currently working in to be used for testing purposes only. Any changes made in this test organization will not affect your live production data.

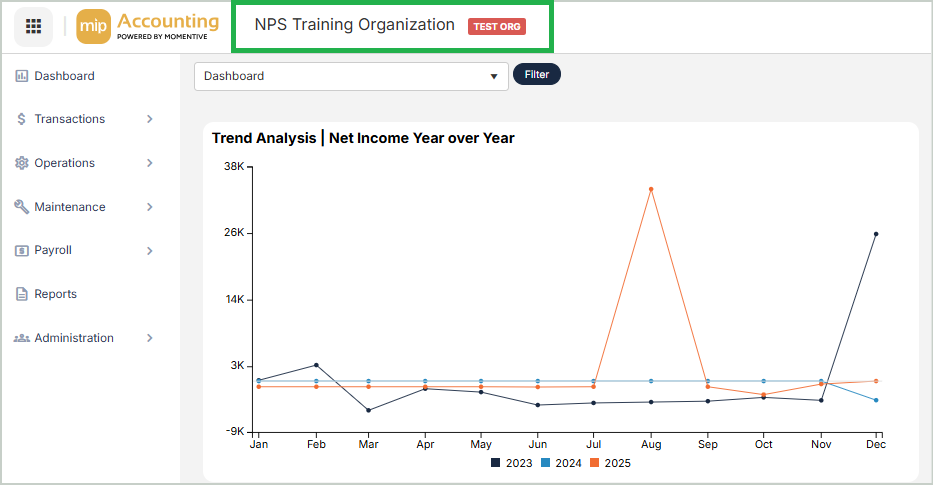

Note: The new test organization settings will only take effect after you log out and back in to MIP.

Once you log back into MIP and have the test organization selected, you'll receive a pop-up message that allows you to select a different organization or proceed with using the test organization.

TEST ORG will display in the header next to the organization name to indicate that you're working in a test organization.

Federal Tax Identification Number

FEIN: The Federal Employer Identification Number. Selected by default.

Foreign: Select this option if your organization uses a foreign tax identification number.

Federal Tax Identification Number: Your organization's federal tax identification number.

1099 State Withholding Information

State: Select your organization's state from the drop-down list.

State Tax ID: Enter your organization's state tax ID.

IRS Tax Form Preference

Form 990EZ: Select this option to enable Form 990EZ for your organization.

Form 990: Select this option to enable Form 990 for your organization.

Government N/A: Select this option if your organization does not require a form.

Once you're finished with your edits, Save your changes.

Use the Address tab to view or update your organization's address information.

Address

Address: Enter your organization's street address.

City: Enter your organization's city.

State/Province: Enter your organization's state/province.

Postal Code: Enter your organization's postal code.

Country: Enter your organization's country.

Contact

Voice: Enter your organization's phone number.

Fax: Enter your organization's fax number.

Email: Enter your organization's email address.

Website: Enter your organization's website.

Once you're finished with your edits, Save your changes.

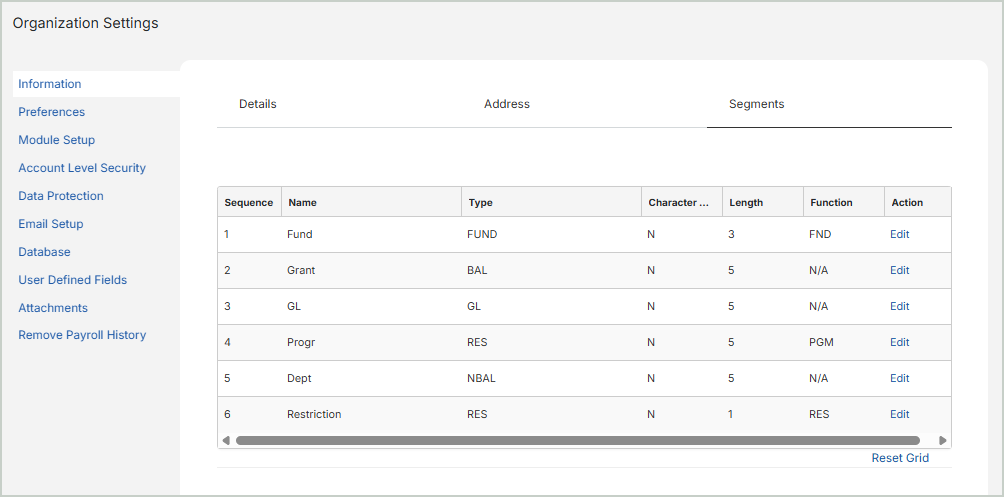

Use the Segments tab to view or edit your organization's segments.

Segment Fields

Sequence: The segment order sequence. The number that you enter here designates the order in which segments appear for transaction entry. Select Edit to edit a segment.

Name: The segment name used to identify each account segment. Remember, the Segment Name is only a title. The segment's behavior is determined by its associated Type. If accepting the default segments provided, the segment name should be modified to meet your organization's unique needs. For example, instead of using Sub Acct 1, you might change it to Location.

Type: The segment type:

- GL (General Ledger) - This required segment type is used for classification of assets, liabilities, revenues, and expenditures. You can only have one GL segment (This is the only segment type that's required in every organization's account structure).

- FUND - This optional segment type is used for recording transactions by fund (where fund is a self-balancing, separate set of books). You can only have one Fund segment in your organization's account structure.

- BAL (Balancing) - This optional segment type is used for transactions - such as departments, grants, and programs - where you want debits to equal credits for each related code.

- NBAL (Non-Balancing) - This optional segment type is used for classification of transactions - such as departments and programs - where you do not require that debits equal credits for each related code. Non-Balancing segments are used in situations where an organization needs to track Revenues and Expenditures, but not balance sheet accounts.

- RES (Restrictions) - This optional segment type is used to classify activity according to ASC 958 (FAS 117 superseded) classifications - unrestricted, temporarily restricted, or permanently restricted. ASC 958: Unrestricted (funds without donor restrictions) or Restricted (funds with donor restrictions).

Character Type: This defines the character set you want to use when naming account codes for each segment. The table below shows each character type and which characters are valid for that type.

| Character Type | Valid Characters |

|---|---|

| Numeric | Numbers 0-9 only |

| Alphabetic | Letters A-Z only (both upper and lowercase) |

| Alphanumeric | 0-9, A-Z, and punctuation (except the invalid characters: | " [] ' %) |

Length: The maximum number of characters allowed when naming account codes for each segment.

Function: The segment function: N/A (Not Applicable), PGM (Program), FND (Function), or RES (Restriction).

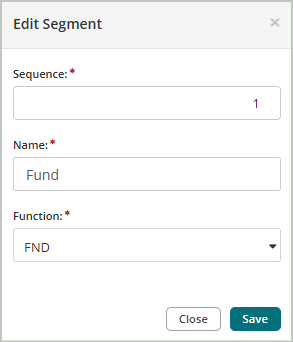

Action: Select Edit in the grid to edit a segment.

Sequence: Enter the updated sequence number for the segment.

Name: Enter the updated segment name.

Function: Select an updated sequence function.

Grant Administration

Use this section to designate the Grant Administration segment. Selecting a Grant Segment enables more details on the Chart of Accounts page. You can enter information about grant terms and grantors for each code segment assigned as the Grant Segment. Only one segment can be designated as the Grant Segment.

Once you're finished with your edits, Save your changes.