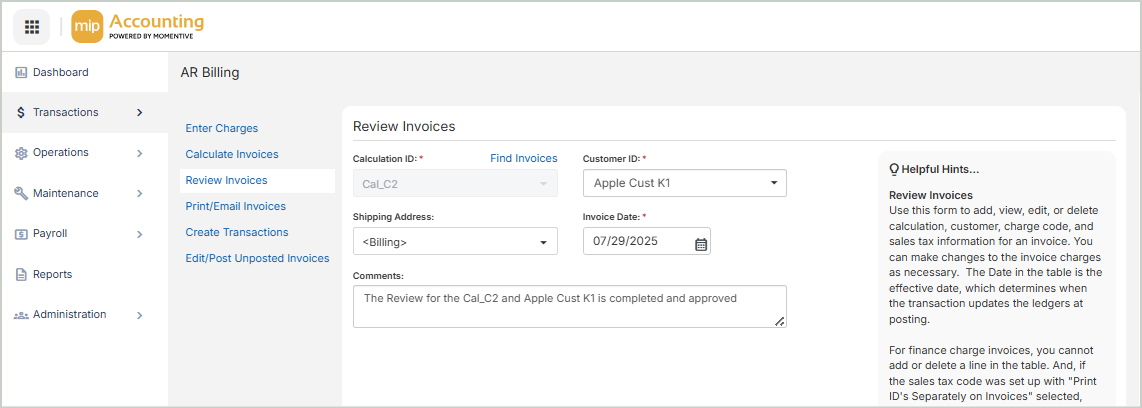

Review Invoices

View & edit calculation, customer, charge code, and sales tax information for an invoice. You can make changes to the invoice charges as necessary. The Charge Date in the grid is the effective date, which determines when the transaction updates the ledgers at posting.

Note: For finance charge invoices, you can't add or delete a line in the grid. Additionally, if the sales tax code was set up with "Print ID's Separately on Invoices" selected, each sales tax line is displayed in the table (see Add / Edit Sales Tax Codes).

Review Invoices

Calculation ID: Select an existing calculation ID. This is the calculation ID that was entered on the Calculate Invoices section.

Customer ID: Select an existing customer ID from the drop-down list.

Shipping Address The customer's address code

Invoice Date: The current date

Comments: Enter any comments about the invoice here.

Charges

Any record in this table can be edited or deleted. Select anywhere in the cell to edit a value, or select a row and select Delete to delete the record.

Charge Date: The charge date

Charge Code: The charge code. This column is not available for finance charge invoices.

Distribution Code: The distribution code associated with the charge code

Description: The description of the charge code

Calculation Period: The calculation period (such as This Month, Quarter, or Year; or Last Month, Quarter, or Year) if the charge code has a calculation method of Percent of Account Activity (PA).

Percentage: The percentage if the charge code has a calculation method of Percent of Account Activity (PA)

Fixed Charge: The fixed charge for the charge code, if applicable

Unit Price: The unit price for the charge code, if applicable

Quantity: The quantity for the charge code, if applicable

Amount: The total amount for the charge code. This calculated column is equal to the unit price, multiplied by the quantity, and added to the fixed charge (Fixed Charge + (Quantity * Unit Price))

Taxable: This checkbox is selected if the Taxable was chosen for the charge code (see Add / Edit Charge Codes).

Totals

Charges: The sum of the "Amount" values in the Charges grid

Sales Tax: The sales tax associated with this invoice. This column is not available for finance charge invoices.

Total: The total of all charge codes, plus any applicable sales tax

Once you're finished with your edits, Save your changes.