Charge Codes

Charge codes represent the products or services billed to customers on AR invoices. Each code is linked to a revenue account and includes pricing details - helping track service charges, finance charges, sales taxes, and more.

Learn how to Add / Edit Charge Codes.

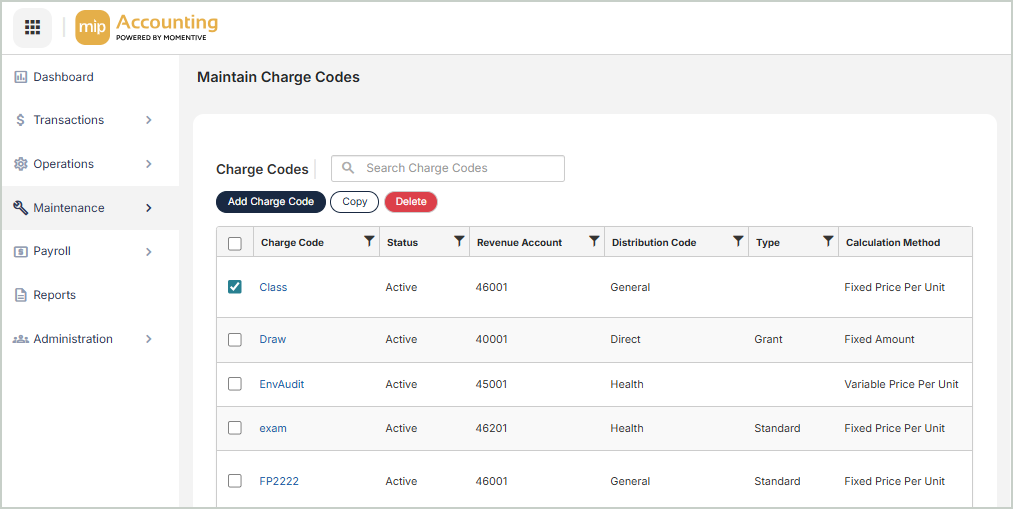

Charge Codes Grid

The Charge Codes grid includes the following columns:

Charge Code: The unique ID for the charge code. Select a code to edit the charge code.

Description: The full description of the charge code

Status: The current status of the charge code (Active, Inactive, or Discontinued)

-

Active (A) - A charge code is set to active when it's used for normal entry.

-

Inactive (I) - A charge code is set to inactive when it's no longer being used for normal entry, but it still may need to be used at some point. A warning message appears when attempting to use an inactive charge code. The warning message is for notification only; you can still proceed. Inactive codes appear on reports.

-

Discontinued (D) - A charge code is designated as discontinued when it's no longer being used. The system does not allow entry for discontinued charge codes; however, they do appear on reports.

Revenue Account: The valid general ledger account for the charge code. General ledger account codes were created through Maintenance > General Ledger > Chart of Accounts.

Distribution Code: The distribution code of the charge code. Distribution codes were created through Maintenance > General Ledger > Distribution Codes.

Type: The type of charge code. Types are used to limit or sort charge codes on reports. For example, use types such as Product or Service to distinguish between the types of charge codes being billed.

Calculation Method: The calculation method selected from one of the following options:

-

Fixed Amount (FA), Fixed Price per Unit (FP) - For FA and FP, an amount is entered in the value box. That amount is applied to the charge code either as a fixed charged (FA), regardless of units sold, or a unit price (FP), which is then multiplied by the units sold to calculate the total charge.

-

Variable Price per Customer (VC) - For VC, a value or price to associate with the charge code is not specified. The price is entered on the invoice when applying the charge code, since the price varies depending on the customer to whom the item is sold or supplied.

-

Variable Price per Unit (VP), Alternative Variable Price/Unit (AV) - VP and AV allow you to calculate based on incremental units. You can set up a calculation table in which you specify the price depending on the number of units sold. Therefore, customers can be given a more favorable price if they buy or use more units. VP and AV also give the ability to assess a Unit Price in addition to a Fixed Charge. An example of this is a utility bill. There is a service charge assessed regardless of the usage. Additionally, a price is applied per unit for usage, and the unit price changes depending on the number of units used.

-

Percent o f Account Activity (PA) - For PA, a Percentage to calculate based on the nest of the selected segment's current activity for the selected period (Period for Calculation) is entered. The GL Code is always required for this method. Period for Calculation is used to select rolling dates for calculations.

Freight: If selected, the charge code is subject to sales tax.

Taxable: If selected, the charge code is designated to be freight. Freight is only available for non-inventory related charge codes.

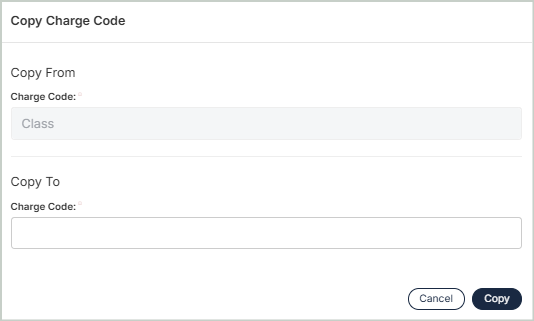

Copy Charge Codes

You can create an exact duplicate of an existing charge code. Simply select the charge code to copy from and enter a new name to copy to. Once you select Copy, you'll see your new charge code in the grid.

Delete Charge Codes

Before deleting a record, ensure you’ve selected the correct record you want to remove from the system. Deletion is permanent and cannot be undone.