Asset Types

Set up new asset types or edit existing asset types. You must have at least one asset type set up before an asset can be entered into the system.

Asset Types are used to define a group of similar items that are depreciated with the same method and have the same coding for accounting entries. Having asset types allows you to process, view, manage, and report multiple assets of the same type together. Some common examples of asset types include Furniture, Vehicles, or Office Equipment.

An asset's type determines what accounting entries are made for it. Asset types include the following transaction coding:

- The fixed asset general ledger account (used for disposals)

- The accumulated depreciation general ledger account (used for all types of depreciation entries)

- The depreciation expense general ledger account (used for depreciation entries)

- The distribution code

Note: Once you’ve set up an Asset Type, your MIP administrator can define a default asset type through Organization > Module Setup > Fixed Assets. The default asset type will auto-populate when you add a new asset to the system (see Add New Assets).

Add / Edit Asset Types

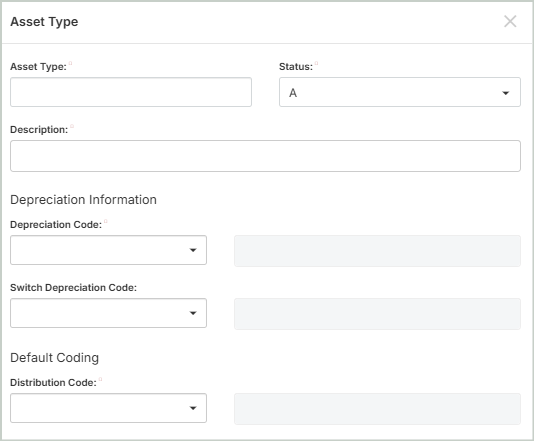

To create a new asset type, select Add Asset Type.

To edit an existing asset type, select it from the grid.

Asset Type: Enter a unique ID for this asset type.

Status: Specify the status of the Asset Type ID. Below are valid status entries and their descriptions:

-

Active (A) - Select "Active" when you want to use an asset type ID throughout the system. Active asset type IDs appear on reports.

-

Inactive (I) - Select “Inactive” when you don’t want to use the asset type regularly, but may still need to use it at some point. A warning message will appear when you attempt to use inactive asset type IDs. Inactive IDs still appear on reports.

-

Discontinued (D) - Select "Discontinued" when you no longer want to use the asset type.

-

When adding new assets, you cannot assign it a "Discontinued" asset type; however, discontinued asset type IDs will still appear on reports.

-

Description: Enter the description for the asset type.

Depreciation Information

Depreciation Code: Select a depreciation code from the drop-down list. You can select a standard code (SL, SYD, DB150, DB200, or NO), or a custom code you created.

-

This depreciation code is used for every asset assigned this asset type.

-

To add or edit a depreciation code, see Custom Depreciation Codes.

Switch Depreciation Code: Select an alternate depreciation code for the asset type when you use an accelerated depreciation method.

-

When the corresponding SL depreciation amount exceeds the amount calculated in the accelerated depreciation schedule, the asset is "switched" to the straight-line method for the remaining life of the asset.

Default Coding

Note: If you don't have any EXP or FAO account types set up in your Chart of Accounts, you won't be able to select an Expenditure, Accumulated Depreciation, or Asset account. You must set these up in your Chart of Accounts before proceeding (see Set Up the Fixed Assets Module).

Note: If you "switch" your depreciation code to Straight Line, it must remain Straight Line. Regardless of the custom depreciation you set up, you cannot switch your depreciation to another code.

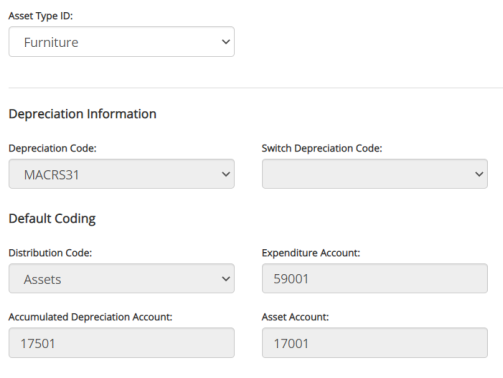

Distribution Code: Select a distribution code for this asset type. This code is used during depreciation and disposal transfers.

For multicurrency users, the Distribution Code field only displays codes that either share the same currency as the function currency, or have a currency of ANY.

Expenditure Account: Select a general ledger expense account (EXP account type) for this asset type (this account is the debit for the entry). This code is used during depreciation and disposal transfers.

-

In order to enter an expenditure account, you must have already created expenditure accounts in your chart of accounts (Maintenance > General Ledger > Chart of Accounts). For more information on creating and maintaining account codes in your Chart of Accounts, see Add / Edit Chart of Accounts Codes

Accumulated Depreciation Account: Select a general ledger asset account (FAO account type) for accumulated depreciation (this account is the credit for the entry). This code is used during depreciation and disposal transfers.

Asset Account: Select a general ledger asset account (FAO account type) for the asset. This code is used for recording disposal entries.

-

In order to enter an Accumulated Depreciation Account and Asset Account, you must have created a general ledger asset account (FAO) in your chart of accounts (Maintenance > General Ledger > Chart of Accounts).

Once you're finished with your edits, Save your changes.

Copy Asset Types

You can create an exact duplicate of an existing asset type. Simply select the asset type to copy from and enter a new name to copy to. Once you select Copy, you'll see your new asset type in the grid.

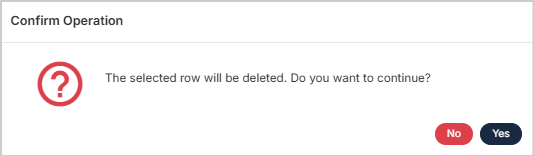

Delete Asset Types

Before deleting a record, ensure you’ve selected the correct record you want to remove from the system. Deletion is permanent and cannot be undone.

FAQs

Asset types have multiple accounting codes linked to them. This means that an asset's type will affect calculations and will impact your general ledger. See the image below for an example of the codes associated with asset types.

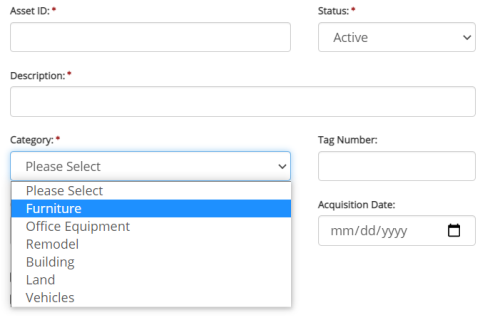

Categories are used for reporting purposes, to group assets. Categories do not have any accounting codes associated with them.

You can create categories when adding new assets into the system (through Maintenance > Fixed Assets > Fixed Assets > Add New).

Note that categories created in the Fixed Assets module cannot be utilized in other modules (such as Purchase Orders and Electronic Requisitions).