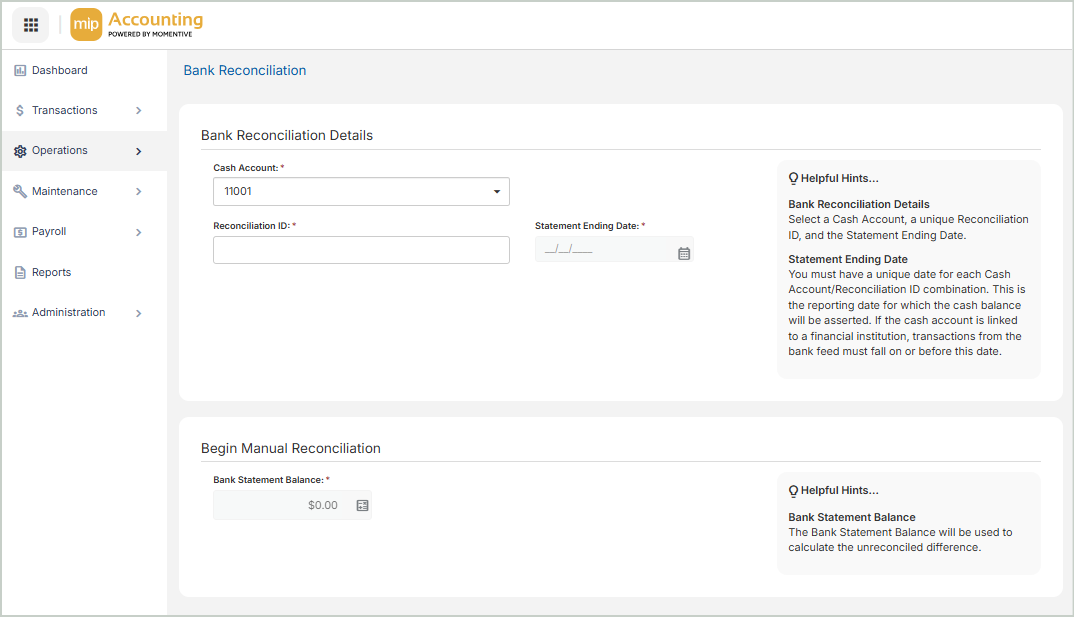

Add Bank Reconciliation

The fields you see here depend on whether your organization uses the standard manual reconciliation or has connected a bank account through Mastercard’s open banking platform (Finicity) for automatic reconciliation.

-

Manual Bank Reconciliation is the default and available to all organizations.

-

Automatic Bank Reconciliation becomes available only after you establish a bank connection under Module Setup > Connect to Financial Institution.

Select the type of reconciliation your organization performs to follow the correct workflow:

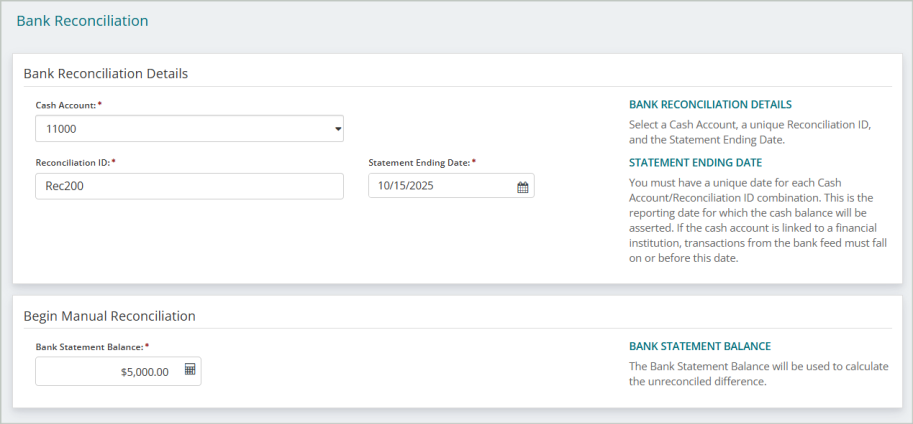

Manual

Bank Reconciliation Details

Cash Account: Select the cash account you want to reconcile.

Reconciliation ID: Enter a unique identifier for this reconciliation.

Statement Ending Date: Enter the ending date of the bank statement you're reconciling.

Begin Manual Reconciliation

Bank Statement Balance: Enter the ending balance from your bank statement.

-

This is used to calculate the unreconciled difference between the statement and your ledger activity.

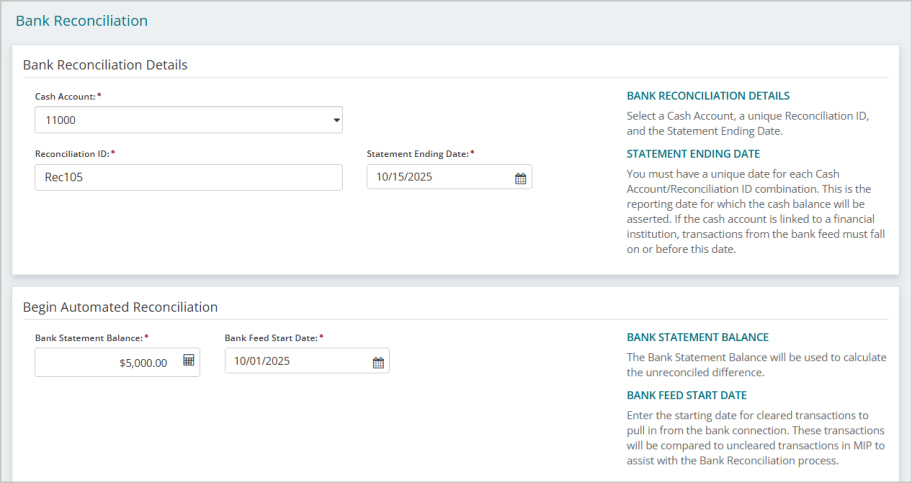

Automatic

Bank Reconciliation Details

Cash Account: Select the cash account you want to reconcile. Ensure that you've selected the correct GL code that you set up when you established your bank connection through Module Setup > Connect to Financial Institution.

Reconciliation ID: Enter a unique identifier for this reconciliation.

Statement Ending Date: Enter the ending date of the statement you are reconciling.

-

If the cash account is linked to a financial institution, only transactions dated on or before this date will flow in from the bank feed.

Begin Automated Reconciliation

Bank Statement Balance: Enter the ending balance from your bank statement.

-

This is used to calculate the unreconciled difference between the statement and your ledger activity.

Bank Feed Start Date: Enter the first date from which MIP should pull cleared transactions from your bank connection.

-

These transactions will be compared against uncleared activity in MIP to help you reconcile.

Note: We recommend setting your Bank Feed Start Date approximately 45 days before the Statement Ending Date. This helps ensure that all transactions for the full period have sufficient time to clear and appear in the bank feed.